The rise of blockchain technology and cryptocurrency has created new ways to earn passive income. Cryptocurrency now offers more than just trading digital assets; it includes passive income opportunities, such as participating in gaming experiences.

Passive income in cryptocurrency involves earning money with minimal effort. Traditional methods, like earning interest from a savings account, have been a staple in the financial industry. Similar tools in the cryptocurrency market offer ways to earn passive income with minimal involvement. For example, locking a cryptocurrency on an exchange for a certain period can generate profits without active trading and constant market monitoring.

Generating passive income in the crypto sector involves allocating funds to various methods, each of which is described in detail below. While this approach is generally considered safe and simple, it is not without risks. It is important to understand these risks and approach them with caution.

Passive income in the world of cryptocurrency can be obtained from various activities that require minimal active participation. Regular income can be earned through staking or lending, which provides interest payments, while mining offers rewards in the form of newly minted coins.

To maximize profits from passive cryptocurrency income, thorough research and strategic planning are vital. Choosing methods that align with your investment goals and risk tolerance, diversifying your strategies, and staying informed about trends and changes in the cryptocurrency market can increase your chances of earning stable and sustainable passive income. However, it is important to remember that profits can be affected by various factors, such as cryptocurrency price fluctuations, network demand, and the level of market participation.

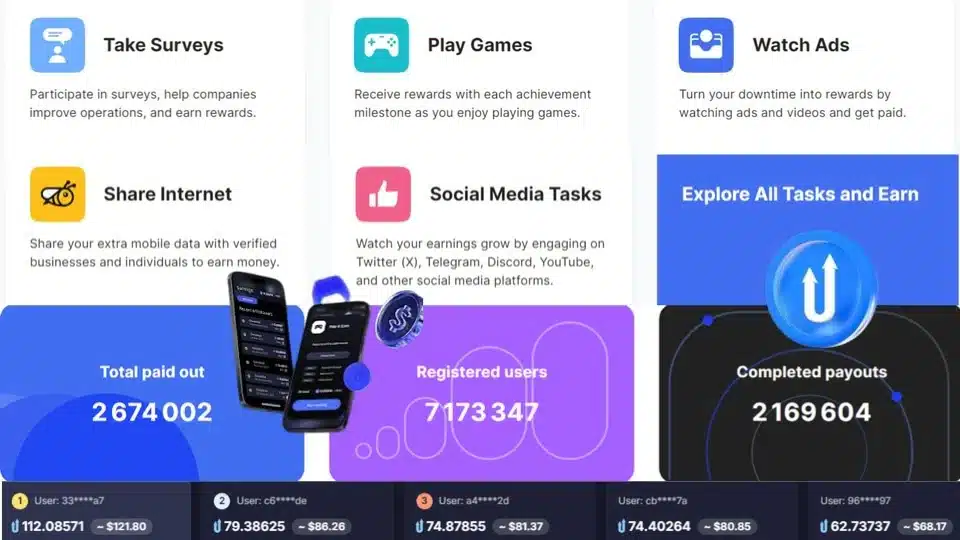

There are many strategies available for generating passive income through cryptocurrencies, each offering distinct benefits when used effectively. Key methods include staking, where you lock up coins to support the network and earn rewards; liquidity mining, which involves providing liquidity to a trading pair on decentralized exchanges; and cryptocurrency lending, where you lend your digital assets to others and earn interest. Additionally, the growing trend of play-to-earn games allows participants to earn cryptocurrency rewards through gaming activities.

To optimize profits and minimize risks, conducting thorough research and understanding the specific mechanics and requirements of each method is crucial. Staying abreast of market trends and adjusting strategies as needed can also significantly increase the potential for lucrative returns in the dynamic world of cryptocurrencies.

Staking Crypto

Staking crypto involves locking your digital tokens to a blockchain network to earn rewards, usually a percentage of the tokens staked. This is known as the “proof-of-stake” (PoS) consensus mechanism, where token holders can participate in validating transactions and creating new blocks on the blockchain.

How Does Staking Crypto Work?

When you stake your digital assets, your crypto is locked for a set period to support the security of the blockchain. In return for staking, you earn rewards in the form of additional cryptocurrency. Many blockchains use a proof-of-stake consensus mechanism, requiring network participants to stake sums of cryptocurrency to support the blockchain.

Types of Staking Crypto

There are several ways to participate in crypto staking:

- Solo Staking: You validate transactions and earn rewards by operating your own node.

- Staking as a Service (SaaS): You outsource node operations to earn rewards, but pay a monthly fee.

- Pooled Staking: You join a group of stakers to increase your chances of being selected as a validator.

Benefits of Staking Crypto

- Earn passive income in the form of cryptocurrency rewards

- Contribute to the security and validation of the blockchain

- Participate in the validation of transactions and creation of new block

- Diversify your cryptocurrency portfolio

Risks of Staking Crypto

- Locking up your cryptocurrency for a set period may result in missed market opportunities

- Risk of losing staked cryptocurrency if you are selected as a validator and make an error

- Dependence on the blockchain’s staking mechanism and rewards structure

Best Cryptocurrency Staking Platforms

OKX Simple Earn, Staking, DeFi, Farming

Liquidity mining

Liquidity mining, also known as yield farming, is a method of earning passive income by contributing to liquidity pools. It involves receiving tokens or fees as a reward for providing liquidity to a DeFi (decentralized finance) protocol. This strategy is commonly used by new protocols to distribute their tokens and attract users.

Key points

- Liquidity mining is a type of yield farming where participants earn tokens for providing liquidity to a DeFi protocol.

- Yield farming is a passive way to earn income by contributing to liquidity pools.

- Users earn interest based on the reward percentage allocated for their pool.

- The deposited liquidity is used to provide crypto loans to others, and the user earns a portion of the interest.

- Yield farming is commonly used by new protocols to distribute tokens and attract users.

Best practices

- Research and understand the DeFi protocol and its risks before participating in yield farming.

- Monitor the market and adjust your strategy to maximize returns.

- Be aware of the risks associated with lending and borrowing speculative tokens.

- Consider the fees and rewards offered by different platforms before making a decision.

By understanding liquidity mining (yield farming) and its mechanics, you can make informed investment decisions and potentially generate passive income in the world of DeFi.

Cadabra Finance DeFi Magic Yields

Crypto Lending

Crypto lending is the process of depositing cryptocurrency that is lent out to borrowers in return for regular interest payments. Payments are made in the form of the cryptocurrency that is deposited, typically compounded daily, weekly, or monthly.

How Does Crypto Lending Work?

Crypto lending is a financial transaction where one party lends cryptocurrency to another party in exchange for compensation. This process is similar to traditional lending, but instead of banks, crypto lending is facilitated by crypto lending platforms. These platforms can be either centralized or decentralized, providing different benefits and risks.

Types of Crypto Lending Platforms

There are two main types of crypto lending platforms: decentralized and centralized. Decentralized platforms operate on blockchain technology, allowing for peer-to-peer lending, while centralized platforms are operated by a company and provide more traditional lending services.

Benefits of Crypto Lending

Crypto lending provides an opportunity for investors to earn interest on their crypto holdings, similar to interest payments earned in a traditional savings account. It also allows borrowers to access crypto assets without having to sell them, providing a way to maintain their investment while still accessing liquidity.

Conclusion

Crypto lending is a growing market that provides an opportunity for investors to earn interest on their crypto holdings. With the rise of decentralized finance (DeFi) platforms, crypto lending has become more accessible and flexible, allowing users to lend out their assets and earn interest without having to sell them.

Investing in Nexo

Cloud Mining

Cloud mining allows individuals to mine cryptocurrencies such as Bitcoin without the need for upfront investment in hardware. This approach shifts the burdens of equipment setup, operation, and maintenance to third-party providers. It’s a more accessible and less capital-intensive way to participate in Bitcoin mining, especially during critical market events like the Bitcoin halving.

How does cloud mining work?

Cloud mining allows individuals to participate in cryptocurrency mining without needing to own or manage the mining hardware themselves. Users rent mining capacities from a company that owns and manages the mining hardware and process. When the rented mining hardware mines a block, the rewards are shared among the users and the company.

Benefits of cloud mining

- Accessibility: Cloud mining provides a more accessible avenue to mining, eliminating hardware and operational challenges.

- Cost-effectiveness: Cloud mining eliminates the need for upfront hardware investments, making it a more cost-effective option.

- Scalability: Users can scale their mining operations up or down as needed.

Risks of cloud mining

- Security risks: Entrusting assets to a third-party provider can pose security risks.

- Unreliable providers: Some cloud mining providers may be unreliable or even scams.

- Diminishing profits: Increasing mining difficulty and more miners entering the networks can lead to diminishing profits.

Cloud mining is a viable option for those looking to participate in cryptocurrency mining without the need for upfront hardware investments. However, it is essential to be aware of the risks and benefits involved. Research and due diligence are crucial before choosing a cloud mining provider.