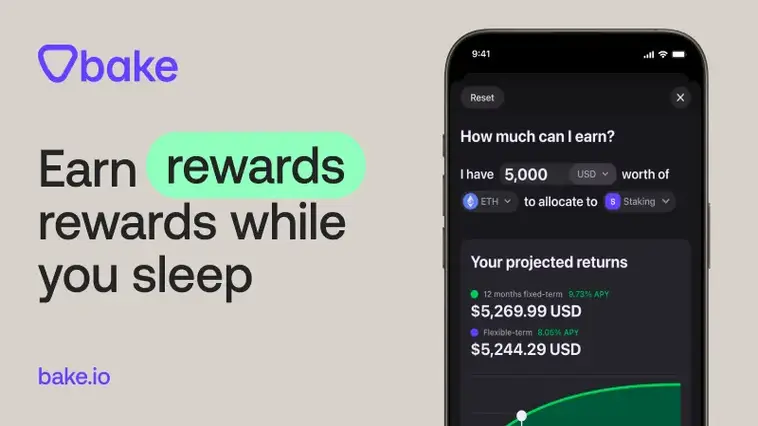

Which Bake Service is Right for You: Crypto Staking, Yield Vault, or Liquidity Mining?

All Bake services are designed to help you earn passive income from your crypto in a safe and transparent way. It is important to choose the right service that fits your financial situation, needs, and strategies to maximize the success of your crypto investments.

What are DeFi Services?

DeFi services are a new way to access financial services without using centralized organizations like banks and brokers. They are powered by blockchain technology and offer users access to financial products, including loans, savings accounts, exchanges, investments, and more, in a peer-to-peer manner that is faster and cheaper than traditional systems.

The benefits of DeFi services include increased privacy and control over funds, lower fees, no need for credit checks or bank accounts, and automated smart contracts. DeFi also has the potential to democratize access to capital markets and create greater global economic inclusion.

However, there are also downsides to consider, such as the early stages of blockchain technology, concerns about decentralization, and regulatory uncertainty.

Let’s explore Bake services to boost DeFi income

Crypto Staking

Crypto staking is the process where crypto holders volunteer to verify transactions on the blockchain. To participate, you need to stake your crypto for a specific period of time and, in return, you will receive rewards based on the type and amount of crypto you have staked.

Advantages of crypto staking:

1. Easy to use: Crypto staking doesn’t require technical knowledge. With just a click, you can start generating rewards on your crypto.

2. No lock-up period: Although staking for a longer period yields more rewards, you can choose to unstake at any time (except for ETH, which has limitations).

3. Low cost: You don’t need a large amount of crypto to participate. In most cases, you can stake for as little as $1 worth of crypto.

4. Accessibility: The Crypto Staking service is available for both web and mobile users.

5. Competitive yields: Users can generate rewards at reasonably competitive yield percentages (e.g., DFI yields around 12% APY).

6. Covered by ELITE: You can boost your staking rewards by signing up for ELITE membership.

Disadvantages of crypto staking:

1. Limited to specific types of crypto: You can only participate if you own Proof-Of-Stake (PoS) cryptocurrencies such as DASH, DeFiChain (DFI), ETH, and MATIC.

2. May be subject to stricter regulations: Recent regulatory actions may affect crypto staking service providers. For instance, the US SEC alleged that crypto staking services constitute unregistered securities, and the NY Attorney General listed ETH as a cryptocurrency that may be considered securities. The impact of these developments on service providers is currently unclear.

YieldVault

YieldVault is a tool that allows users to easily generate crypto rewards with just a few clicks, while also enjoying the added value of transparency.

Key Advantages of YieldVault:

1. Ease-Of-Use: YieldVault simplifies the process of earning interest on DeFiChain. Instead of spending time understanding the complexities involved in the process or taking on the risk of making mistakes and losing funds, you simply need to allocate funds into YieldVault, sit back, relax and enjoy the rewards generated.

2. Transparency: All YieldVault transactions occur directly on the blockchain. This means that you can always verify what’s happening with your investments, and the rewards can be tracked and verified on-chain through the wallet address given on our Transparency Page.

3. Generate rewards on popular crypto: You may choose to receive the same type of cryptocurrency that you’ve allocated as your preferred payout (e.g., if you allocated BTC, you will receive rewards in BTC). However, to maximize your gains and generate competitive crypto rewards, you should choose Decentralized USD (DUSD) as your preferred rewards payout.

4. No lock-up period: Although allocating your crypto into YieldVault for a longer period will yield more rewards, you can choose to withdraw it at any given moment.

5. Low-cost: You don’t need to allocate a huge amount of crypto into YieldVault. In most cases, you can allocate for as little as $1 worth of crypto.

6. Covered by ELITE: You can further boost your Yieldvault rewards if you sign up for ELITE membership.

YieldVault is only available on the Bake mobile app.

Liquidity Mining Service

Liquidity mining is a way to reward users who provide liquidity for decentralized finance (DeFi) projects by allocating a pair of crypto assets. This pair consists of two different cryptocurrencies, such as Bitcoin and DFI, and it’s important to maintain the predetermined ratio between these two currencies to maximize rewards. The rewards typically consist of the same type of crypto pairs initially allocated by the user.

What are the key advantages of liquidity mining?

1. Highly competitive yields: Users can generate rewards based on highly competitive yield percentages (e.g., EUROC – DUSD is at around 21.51% APR).

2. Rewards on two types of crypto: Liquidity mining rewards are based on the crypto pair allocated.

3. Ease-of-use: Our Liquidity Mining service allows participation without requiring technical skills and knowledge, and without needing to own a large amount of funds.

4. Accessibility: Our Liquidity Mining service is available for both web and mobile users.

5. Covered by ELITE: You can boost your Liquidity Mining rewards by signing up for ELITE membership.

What are the key disadvantages of liquidity mining?

1. Market volatility: DeFi tokens tend to be more volatile than other assets, posing a higher risk for sharp price swings and potential loss for liquidity miners staking funds long-term.

2. Impermanent loss: This occurs when a user provides capital at one price and then withdraws at a lower price.

3. Crypto pairs are required: To participate in liquidity mining, you must allocate a pair of cryptocurrencies or be willing to convert a portion of your crypto into another type to make a liquidity mining pair.

4. Ratio must be met and maintained: Specific ratios must be met and maintained for each liquidity mining pair.

Which Bake service is best for you?

Bake Crypto Staking service is ideal if:

- You’re a novice or mid-level crypto investor.

- You have limited funds.

- You own a PoS cryptocurrency.

- You’re willing to take on the risk of stricter regulations for crypto staking services.

Bake YieldVault service is ideal if:

- You’re a novice crypto investor.

- You have limited funds.

- You want to generate passive income on Bitcoin and other popular cryptocurrencies.

- You value ease-of-use over high yields.

- You are risk-averse.

Bake Liquidity Mining service is ideal if:

- You’re an advanced crypto investor.

- You have enough funds to meet the required ratio of liquidity mining pairs.

- You own multiple types of crypto or are open to swapping a portion of your crypto for a different type to create a liquidity mining pair.

- You have a high risk tolerance.

So, what are you waiting for?

Sign up now and take control of your financial destiny!